Table of Contents

ToggleIntroduction

Fintech companies are businesses that use technology to provide financial services and solutions to consumers and businesses. These companies are often characterized by their innovative approach to financial services, using technology to create new and more efficient ways of delivering financial products and services. Fintech companies can offer a wide range of financial services, including payments, lending, insurance, investing, and more. Many fintech companies specialize in one particular area of financial services, while others offer a variety of services. Fintech companies often differ from traditional financial institutions in their approach to customer service and user experience. They use digital platforms and mobile apps to provide a seamless and user-friendly experience for their customers.

Fintech Market Growth Projections

In 2023, the fintech industry is expected to continue its growth trajectory, with the market size predicted to reach $165.17 billion. As users become more tech-savvy, the banking industry is increasingly adopting fintech solutions, including embedded finance and SaaS services. Looking ahead, several technology trends are set to shape the fintech industry in 2023. According to growth projections, the fintech market is expected to reach $324 billion by 2026, with a compound annual growth rate (CAGR) of 25.18%.

Here’s a glimpse of the expected progress of the fintech market in the next five years:

| Year | Market Valuation Calculated Based on CAGR |

| 2021 | $105.41 billion |

| 2022 | $131.95 billion |

| 2023 | $165.17 billion |

| 2024 | $206.76 billion |

| 2025 | $258.83 billion |

| 2026 | $324 billion |

| 2027 | $405.58 billion |

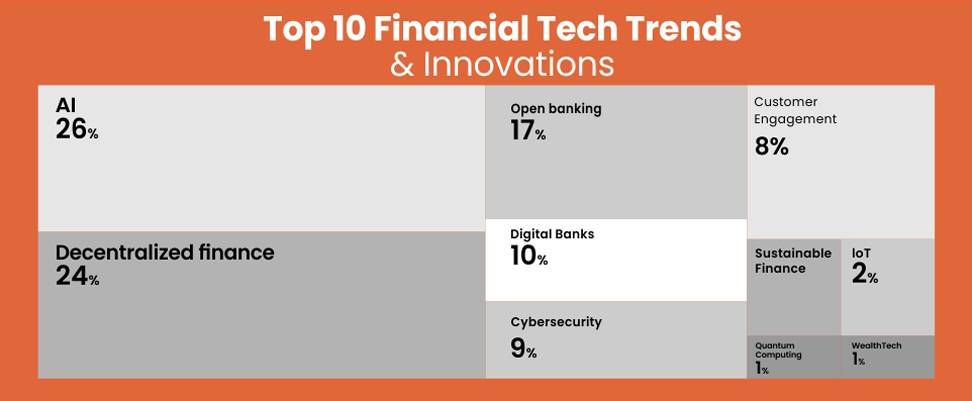

Trends driving Fintech Industry in 2023

Digital Payments

The shift towards digital payments has been accelerated due to the COVID-19 pandemic. Consumers and businesses alike are looking for contactless and convenient payment options, driving the growth of mobile payments, digital wallets, and payment processing solutions.

Blockchain and Cryptocurrency

Fintech companies are using blockchain technology to create decentralized and secure financial systems. This technology enables secure and transparent transactions without the need for intermediaries, reducing costs and increasing efficiency. Cryptocurrencies like Bitcoin, Ethereum, and others are becoming increasingly popular as a store of value and a means of payment. Fintech companies are developing solutions to make it easier to buy, sell, and use cryptocurrencies, and large financial institutions are also starting to offer cryptocurrency services.

Personalized Financial Advice

With the rise of robo-advisors and other digital investment platforms, consumers seek personalized financial advice to help them achieve their financial goals. Fintech companies are using artificial intelligence and machine learning algorithms to provide customized investment advice and portfolio management.

Open Banking

Open banking is a regulatory framework that allows consumers to share their financial data with third-party providers. This enables fintech companies to offer innovative financial products and services, such as personalized budgeting tools, without having to develop their own banking infrastructure.

Digital Lending

Fintech companies are disrupting the traditional lending industry by offering digital loan applications, faster approval times, and lower interest rates. Online lenders are using data analytics and machine learning algorithms to better assess credit risk and provide loans to underserved populations.

Regtech

The regulatory technology or “regtech” industry is growing as financial institutions seek to comply with regulations. Fintech companies are developing solutions that can automate compliance processes, improve risk management, and reduce costs associated with regulatory compliance.

Neobanks

Neobanks are digital-only banks that offer a range of financial products and services through mobile apps. These banks are gaining popularity among younger consumers who are looking for more flexible and convenient banking options. Neobanks are also able to offer lower fees and better interest rates than traditional banks due to their lower overhead costs.

Data Analytics

Fintech companies are using advanced analytics to collect, analyze, and interpret large volumes of data. This helps them to gain insights into customer behavior, identify trends, and make data-driven decisions.

Artificial Intelligence (AI)

Fintech companies are using AI to automate processes, personalize services, and improve customer experiences. AI-powered chatbots, robo-advisors, and fraud detection systems are some examples of how fintech is using AI.

The US Fintech Market Value Projections

The fintech market in the United States was USD 4 trillion in 2022. The global fintech transaction value is expected to be dominated by the United States, accounting for over 62% by 2025.

Don't miss out on your chance to work with the best

apply for top global job opportunities today!

Top Fintech Companies in the USA in 2023

| Company | Market Value (USD) | Annual Revenue (USD) | Headquarters |

| Visa | 488.53 billion | 30.983 billion | San Francisco, California |

| Mastercard | 362.88 billion | 22.818 billion | Purchase, New York |

| Intuit | 119.98 billion | 13.684 billion | Mountain View, California |

| PayPal | 73.99 billion | 27.51 billion | San Jose, California |

| Fiserv | 73.70 billion | 18.146 billion | Brookfield, Wisconsin |

| Square | 35.88 billion | 18.561 billion | San Francisco, California |

| Ripple | 23.1 billion | 1.5 billion | San Francisco, California |

| Coinbase | 14.12 billion | 736.4 million | San Francisco, California |

| Plaid | 13.4 billion | 39.6 million | San Francisco, California |

| Opensea | 13.3 billion | 571.1 million | New York City |

| Brex | 12.3 billion | 3.5 million | San Francisco, California |

| Toast | 10.30 billion | 987 million | Boston, Massachusetts |

| Bill.com | 10.25 billion | 229.9 million | San Jose, California |

| Gusto | 9.3 billion | 290 million | San Francisco, California |

1. Visa

Market Value

Annual Revenue

Headquarters

$488.53 billion

$30.983 billion

San Francisco, CA

Visa is a global payments technology company that facilitates electronic funds transfers throughout the world. It operates the world’s largest retail electronic payments network and provides services to consumers, businesses, and governments.

Services offered

- Payment processing

- Digital payments

- Fraud prevention

- Data analytics

- Business solutions

- Financial inclusion initiatives

2. Mastercard

Market Value

Annual Revenue

Headquarters

$362.88 billion

$22.818 billion

Purchase, New York

Mastercard is a global payments and technology company that enables transactions in more than 210 countries and territories. It operates the world’s second-largest payment network and provides services to consumers, businesses, and governments.

Offered Services

- Payment processing

- Digital payments

- Fraud prevention

- Data analytics

- Business solutions

- Loyalty and rewards programs

- Biometric authentication technology

- Contactless payments technology

- Mobile payments technology

- Cross-border payments services

- Prepaid card services

- Financial inclusion initiatives

3. Intuit

Market Value

Annual Revenue

Headquarters

$119.98 billion

$13.684B

Mountain View, CA

Intuit is a financial software company that provides financial, accounting, and tax preparation software to consumers and small businesses. Its products include QuickBooks, TurboTax, and Mint.

What does Intuit offer?

- QuickBooks: An accounting software for small businesses and self-employed individuals.

- TurboTax: A tax preparation software for individuals and small businesses.

- Mint: A personal finance management tool that allows users to track their expenses, set budgets, and monitor their credit scores.

- Credit Karma: A free credit monitoring and reporting service that provides users with access to their credit scores and reports.

- QuickBooks Payroll: A payroll processing service for small businesses.

- ProConnect: A tax preparation software for tax professionals.

- TSheets: A time-tracking and employee scheduling software for small businesses.

- QuickBooks Capital: A lending service that provides small businesses with loans based on their QuickBooks data.

- QuickBooks Payments: A payment processing service that allows small businesses to accept credit and debit card payments.

- Lacerte: A tax preparation software for tax professionals.

4. PayPal

Market Value

Annual Revenue

Headquarters

$73.99 billion

$27.51 billion

San Jose, California

PayPal is a global digital payments company that enables payments and money transfers to be made online. It operates an online payment platform that allows customers to pay for goods and services through a secure, user-friendly interface.

Some services offered by PayPal

- PayPal Checkout: A payment processing service for online merchants.

- PayPal Here: A mobile card reader and payment processing service for small businesses.

- PayPal Credit: A line of credit for online purchases that can be paid back over time.

- PayPal.me: A peer-to-peer payment service that allows users to send and receive money using a personalized link.

- Venmo: A peer-to-peer payment app that allows users to send and receive money to friends and family.

- Xoom: A digital money transfer service that allows users to send money internationally.

- Braintree: A payment processing service that allows online merchants to accept credit card and mobile payments.

- Hyperwallet: A payout platform that allows businesses to send payments to freelancers, contractors, and other third-party payees.

- Paydiant: A mobile payment platform that enables businesses to accept mobile payments.

- iZettle: A mobile point-of-sale system and payment processing service for small businesses.

5. Fiserv

Market Value

Annual Revenue

Headquarters

$73.70 billion

$18.146 billion

Brookfield

Fiserv is a global provider of financial technology solutions that offers a broad range of services, including payment processing, financial management, and customer and channel management.

Fiserv services

- First Data: A payment processing service for merchants.

- Clover: A point-of-sale system for small businesses that includes payment processing, inventory management, and customer relationship management features.

- Card Services: A suite of payment card solutions, including credit, debit, and prepaid cards, for financial institutions and merchants.

- Digital Banking: A platform that enables financial institutions to offer online and mobile banking services to their customers.

- LoanServ: A loan servicing platform for financial institutions that includes loan administration, payment processing, and customer service features.

- CheckFreePay: A bill payment processing service that allows consumers to pay their bills in person at retail locations.

- Popmoney: A person-to-person payment service that allows users to send and receive money using email or text messages.

- Mobiliti: A mobile banking platform that enables financial institutions to offer mobile banking and payment services to their customers.

- DNA: A core banking platform for financial institutions that includes account management, transaction processing, and customer relationship management features.

- Fraud and Risk Management: A suite of fraud prevention and risk management solutions for financial institutions and merchants.

6. Square

Market Value

Annual Revenue

Headquarters

$35.88 billion

$18.561 billion

San Francisco, CA

Square is a mobile payment and financial services company that provides payment and point-of-sale systems to businesses of all sizes. It also offers a suite of online tools and services, including e-commerce solutions and business management software.

Services offered by Square

- Square Point of Sale: A mobile point-of-sale system that enables businesses to accept credit card and mobile payments.

- Square for Retail: A point-of-sale system designed for retail businesses that include inventory management and customer relationship management features.

- Square Online: An e-commerce platform that allows businesses to create and manage an online store.

- Square Capital: A lending service that provides small businesses with loans based on their payment processing history.

- Square Payroll: A payroll processing service for small businesses.

- Caviar: A food delivery and pickup platform for restaurants.

- Square Appointments: An appointment scheduling and management system for service-based businesses.

- Square for Restaurants: A point-of-sale system designed for restaurants that include table and order management features.

- Square Dashboard: A mobile app that allows businesses to monitor sales, track inventory, and manage employees.

- Square Card: A debit card that allows businesses to access their Square balance and spend their funds.

7. Ripple

Market Value

Annual Revenue

Headquarters

$23.1 billion

$1.5 billion

San Francisco, CA

Ripple is a technology company that provides a blockchain-based payment protocol for real-time, cross-border payments. Its payment network, called RippleNet, enables banks and financial institutions to send and receive money instantly, securely, and at a low cost.

Ripple provides the below-given services

- RippleNet: This is a global payment network that enables financial institutions to send and receive payments in real-time using Ripple’s blockchain technology.

- On-Demand Liquidity (ODL): This is a service that allows financial institutions to use XRP, Ripple’s native cryptocurrency, as a bridge currency to facilitate cross-border payments. ODL can help reduce the time and cost of cross-border transactions.

- xCurrent: This is a messaging and settlement platform that enables real-time messaging and settlement between financial institutions. It helps financial institutions improve their cross-border payments process by providing end-to-end tracking and transparency.

- xRapid: This is a solution that uses XRP as a bridge currency to facilitate cross-border payments. xRapid is designed to help financial institutions lower costs and increase the speed of cross-border payments.

- RippleX: This is a platform that enables developers to build applications on top of Ripple’s blockchain technology. RippleX provides tools, resources, and support to help developers create innovative applications that leverage Ripple’s technology.

8. Coinbase

Market Value

Annual Revenue

Headquarters

$14.12 billion

$736.4 million

San Francisco, CA

Coinbase is a cryptocurrency exchange that allows users to buy, sell, and trade a variety of digital currencies, including Bitcoin, Ethereum, and Litecoin. It also provides a range of other services, including a digital wallet and merchant services.

Coinbase’ services

- Buy and sell cryptocurrencies: Coinbase allows users to buy and sell a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more, using a variety of payment methods, such as bank transfers, credit cards, and debit cards.

- Coinbase Pro: Coinbase Pro is a professional trading platform for advanced traders that offers features such as advanced order types, margin trading, and trading pairs not available on the standard Coinbase platform.

- Coinbase Wallet: Coinbase offers a mobile wallet that allows users to securely store, manage, and access their digital currencies from their mobile devices.

- Coinbase Card: Coinbase Card is a debit card that allows users to spend their digital currencies anywhere that accepts Visa. Users can convert their cryptocurrencies into fiat currencies instantly and use the card to make purchases.

- Coinbase Earn: Coinbase Earn is a program that allows users to earn free cryptocurrencies by completing educational tasks and quizzes related to various digital currencies.

9. Plaid

Market Value

Annual Revenue

Headquarters

$13.4 billion

$39.6 million

San Francisco, CA

Plaid is a financial technology company that provides a platform for connecting financial accounts to applications. Its software allows users to securely connect their bank accounts to third-party apps and services, enabling them to manage their finances more easily.

Services offered by Plaid

- Account authentication

- Transaction data

- Payment initiation

- Identity verification

- Analytics and insights

10. Opensea

Market Value

Annual Revenue

Headquarters

$13.3 billion

$571.1 million

New York City

OpenSea is a decentralized marketplace for buying, selling, and trading non-fungible tokens (NFTs). Its platform allows users to create, discover, and trade unique digital assets, including art, music, and collectibles.

Opensea services

- Buying and selling NFTs

- Discovering new and unique NFTs

- Creating and managing NFT collections

- Auctions and bidding for NFTs

- Trading NFTs with other users

11. Brex

Market Value

Annual Revenue

Headquarters

12.3 billion

$3.5 million

San Francisco, CA

Brex is a financial technology company that provides credit cards and other financial services to startups and small businesses. Its credit cards are designed to help businesses manage their expenses more efficiently and to provide access to capital.

Brex’s services

- Brex Cash – a cash management account

- Brex Corporate Card – a credit card for businesses

- Brex Travel – a travel rewards program for businesses

- Brex Exclusive Offers – discounts and deals for businesses

- Brex Rewards – rewards program for businesses

12. Toast

Market Value

Annual Revenue

Headquarters

$10.30 billion

$987 million

Boston

Toast is a cloud-based restaurant management platform that provides a range of services, including point-of-sale systems, online ordering, and delivery management. Its software helps restaurants streamline their operations, improve their customer experience, and grow their business.

Toast’s Services

- Point of Sale – a cloud-based point of sale system for restaurants

- Online Ordering – an online ordering system for restaurants

- Toast Payments – payment processing for restaurants

- Gift Cards – a gift card program for restaurants

- Loyalty Program – a customer loyalty program for restaurants

- Kitchen Display System – a digital display for restaurant kitchens

- Reporting and Analytics – real-time data and insights for restaurant owners

- Inventory Management – inventory tracking and management tools for restaurants

- Employee Management – tools for managing restaurant employees

- Marketing and CRM – tools for restaurant marketing and customer relationship management.

13. Bill.com

Market Value

Annual Revenue

Headquarters

$10.25 billion

$229.9 million

San Jose, California

Bill.com is a cloud-based platform for managing accounts payable and accounts receivable. Its software automates the invoicing and payment processes, helping businesses save time and reduce errors.

Services offered by Bill.com

- Accounts Payable Automation – a platform for automating the accounts payable process for businesses

- Accounts Receivable Automation – a platform for automating the accounts receivable process for businesses

- Payment Processing – a platform for processing payments electronically

- Invoicing – a platform for creating and sending invoices electronically

- Approval Workflows – a platform for setting up customizable workflows for approvals and authorizations

- Cash Flow Management – tools and insights for managing cash flow in real-time

- Integrations – integrations with other accounting software and tools

- Document Management – a platform for managing and storing important financial documents

- Mobile App – a mobile app for managing payments and workflows on-the-go

- Virtual Cards – a platform for generating virtual cards for online and remote payments.

14. Gusto

Market Value

Annual Revenue

Headquarters

$9.3 billion

$290 million

San Francisco, CA

Gusto is a cloud-based platform for managing payroll, benefits, and human resources. Its software helps businesses automate their HR and payroll processes, stay compliant with regulations, and provide better benefits to their employees.

Gusto’s services

- Payroll – a platform for managing payroll, including processing payroll, calculating taxes, and issuing payments.

- Benefits – a platform for managing employee benefits, including health insurance, retirement savings, and other perks.

- HR Solutions – a platform for managing human resources tasks, including onboarding, offboarding, and compliance.

- Time Tracking – a platform for tracking employee time and attendance.

- Workers’ Compensation – a platform for managing workers’ compensation insurance.

- Compliance – tools and resources for ensuring compliance with labor laws and regulations.

- Accounting Integrations – integrations with accounting software and tools.

- Employee Self-Service – a platform for employees to access their pay stubs, benefits information, and other HR-related information.

- Contractor Payments – a platform for managing payments to contractors and freelancers.

- Gusto Wallet – a feature that allows employees to access their earned wages before payday.

15. Opensea

Market Value

Annual Revenue

Headquarters

$13.3 billion

$571.1 million

New York City

OpenSea is a decentralized marketplace for buying, selling, and trading non-fungible tokens (NFTs). Its platform allows users to create, discover, and trade unique digital assets, including art, music, and collectibles.

Opensea services

- Buying and selling NFTs

- Discovering new and unique NFTs

- Creating and managing NFT collections

- Auctions and bidding for NFTs

- Trading NFTs with other users

Take control of your career and land your dream job

sign up with us now and start applying for the best opportunities!

Top US Fintech Start-ups to watch in 2023

1. Synctera

Founded

Market Value

Annual Revenue

Headquarters

2020

$15M

N/A

Palo Alto, CA

Synctera is a startup based in the US that provides a BaaS platform to enable financial products and services. Their platform boasts a unique decoupled ledger that can accommodate custom account structures, flows, and relationships. By using centralized customer management, Synctera’s platform reduces the need for manual processes. It also enhances the efficiency of account and transaction reconciliation by processing and controlling transactional, operational, and reference data to prevent the loss of transactions or funds. Furthermore, Synctera’s ledgers are subject to external audits by third-party partners, ensuring compliance with industry standards such as SOC 2, Type II attestation, and PCI DSS certification for payment card data security.

2. Oportun (Previously Digit)

Founded

Market Value

Annual Revenue

Headquarters

2013

$66.3 M

$260M

San Francisco, CA

Oportun is a fintech company based in the United States that provides access to affordable and responsible personal loans. It was founded with a mission to provide financial services to individuals who do not have access to traditional banking services. Oportun uses advanced technology and data analytics to evaluate creditworthiness, and it offers personalized loan options to its customers. In addition to personal loans, Oportun also offers credit cards and financial education resources to its customers.

3. Rocket Money (Truebill)

Founded

Market Value

Annual Revenue

Headquarters

2015

$530M

N/A

Silver Spring

Rocket Money is a finance app that utilizes artificial intelligence (AI) to enable users to manage their finances effectively and reach their financial objectives. The app provides a centralized platform for users to identify, monitor, and pay for subscriptions, recurring bills, and other expenses.

4. Lumanu

Founded

Market Value

Annual Revenue

Headquarters

2017

$12 M

$2M

Oakland, California

Lumanu is a fintech startup that has developed a cutting-edge payments and financing solution tailored for the creator economy. The company’s smartphone app is available directly to clients, including small businesses and large corporations.

5. Rally

Founded

Market Value

Annual Revenue

Headquarters

2016

N/A

$12.0 M

New York

Rally is a platform that facilitates the buying and selling of equity shares in collectible assets. The platform aims to make investing in ideas, emotions, and communities safe, easy, and accessible by bringing people together.

6. CapWay

Founded

Market Value

Annual Revenue

Headquarters

2017

N/A

$18.5 M

Atlanta

CapWay is a digital banking startup that seeks to promote financial empowerment for underserved communities. CapWay provides a customer-focused alternative to traditional banking that is particularly beneficial to individuals and communities without access to banking services.

7. Arthena

Founded

Market Value

Annual Revenue

Headquarters

2013

N/A

N/A

New York

Arthena is a fintech startup that utilizes machine learning and an advanced data pipeline to assist clients in making well-informed art market investments. The platform provides technology-powered, thoroughly researched investment opportunities in the art world. Arthena’s system is continuously evolving, ensuring that customers have access to the most up-to-date information to make intelligent and lucrative investment decisions.

8. Debbie

Founded

Market Value

Annual Revenue

Headquarters

2021

N/A

N/A

Miami, Florida

Debbie allows users to create a custom debt freedom plan and rewards those who stick to their goals. Once all the credit cards are set up, users are able to track all spending and see a visual representation of what it would look like to repay all the debt owed. Every week, new challenges and tasks are created to accomplish debt freedom, and cash rewards are given for every completed task.

9. Chipper Cash

Founded

Market Value

Annual Revenue

Headquarters

2018

$2 B

$12.0 M

San Francisco, CA

Chipper Cash is a fast-growing fintech company that specializes in facilitating cross-border payments and money transfers within Africa. The company was founded in 2018 by Ham Serunjogi and Maijid Moujaled, two entrepreneurs originally from Africa who recognized the need for a simpler, more accessible way for people on the continent to send and receive money. With Chipper Cash, users can send and receive money instantly, securely, and at no cost within any of the seven countries where the service is available. The platform currently operates in Ghana, Kenya, Nigeria, Tanzania, Rwanda, South Africa, and Uganda, and allows users to send money to other users on the platform, as well as to non-users via mobile money and bank transfers.

10. Swan Bitcoin

Founded

Market Value

Annual Revenue

Headquarters

2019

N/A

<$5 million

Los Angeles, California

Swan Bitcoin is a fintech company that specializes in making it easy for individuals to invest in Bitcoin. The platform offers automatic recurring purchases of Bitcoin, as well as educational resources to help users understand the cryptocurrency market. Swan Bitcoin has gained popularity among both new and experienced Bitcoin investors.

Final Thoughts - The Future of Fintech

In the future, fintech is poised to remain a major driving force. The years 2023-2024 are expected to witness a surge in the adoption of blockchain, AI, and IoT technologies in financial transactions. Automation and integration are also expected to become more sophisticated. Consequently, consumers will benefit from more personalized services that cater to their unique needs. As finance continues to be shaped by technological innovation, companies must remain proactive to stay competitive, lest they get left behind.